NEW YORK (CNNMoney) -- U.S. stocks were poised for a higher open Tuesday, with concerns about Europe set to compete for investor attention with a bevy of U.S. economic data on tap.

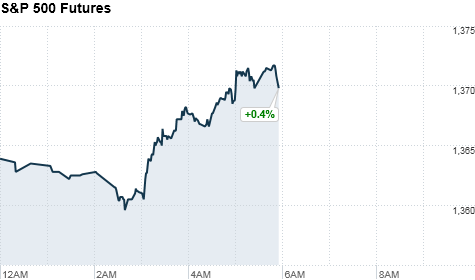

The Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were about 0.4% higher in premarket trading. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

U.S. stock futures followed European markets higher, after the latest edition of an index based on German investor sentiment reportedly came in unexpectedly high.

However, investors remain nervous about Spain, where bond yields rose above 6% earlier Monday -- the highest level in several months. The Spanish government, which will auction bonds later this week, has been struggling with rising borrowing costs amid fears that it may need to be bailed out.

Spanish 10-year yields had eased to 5.91% on Tuesday morning.

On the domestic front, Tuesday brings a slew of corporate earnings for investors to mull over, including results from banking giant Goldman Sachs, along with economic reports on housing starts and building permits.

U.S. stocks closed mixed on Monday, with blue-chips gaining and tech shares falling, as investors weighed conflicting economic data, corporate earnings and renewed worries about Europe.

Stocks are coming off of their worst week of the year. Last week, the Dow tumbled 1.6%, the S&P 500 sank 2% and the Nasdaq tumbled 2.3%.

World markets: European stocks were higher in morning trading after a strong report on German investor sentiment. Britain's FTSE 100 (UKX) added 0.8%, the DAX (DAX) in Germany rose 1.0% and France's CAC 40 (CAC40) climbed 1.1%.

Asian markets ended lower. The Shanghai Composite (SHCOMP) fell 0.9%, while the Hang Seng (HSI) in Hong Kong shed 0.2% and Japan's Nikkei (N225) ended slightly lower.

Economy: Before the opening bell, the Commerce Department will report data on March housing starts and building permits.

Economists are expecting housing starts to increase to an annual rate of 700,000 units, according to a consensus estimate gathered by Briefing.com.

Applications for building permits, an indication of future construction activity, are expected to dip to a seasonally adjusted annual rate of 700,000 units in March.

Companies: Corporate earnings season continues, with Goldman Sachs (GS, Fortune 500), Johnson & Johnson (JNJ, Fortune 500) and Coca Cola (COKE) all releasing first-quarter data ahead of the opening bell.

Analysts surveyed by Thomson Reuters expect Goldman Sachs to release earnings of $3.55 a share. Johnson & Johnson is expected to post earnings of $1.35 per share, while Coca Cola is expected to earn 71 cents per share.

After the close, investors will get the latest numbers from Yahoo (YHOO, Fortune 500), IBM (IBM, Fortune 500) and Intel (INTC, Fortune 500).

Yahoo is expected to release earnings of 17 cents per share, while IBM is expected to post earnings of $2.65 per share.

Currencies and commodities: The dollar fell against the euro and the British pound, but gained against the Japanese yen.

Oil for May delivery rose 84 cents to $103.77 a barrel.

Gold futures for April delivery rose $1.00 to $1,649.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2% from 1.97% late Monday.

No comments:

Post a Comment