NEW YORK (CNNMoney) -- U.S. stocks opened little changed Tuesday, as investors await economic reports.

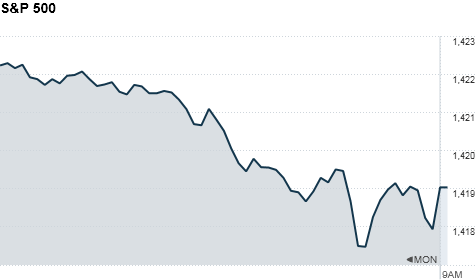

The Dow Jones industrial average (INDU) lost 27 points, or 0.2%. The S&P 500 (SPX) shed 3 points, or 0.2%. The Nasdaq (COMP) dipped 2 points, or 0.1%.

Investors will have some new economic data to consider Tuesday, with reports on auto sales, factory orders and the latest Fed minutes due out in the afternoon.

But market participants expect stocks to stay mostly quiet this week ahead of the Easter holiday.

U.S. stocks ended higher Monday after a manufacturing report showed prices rising less than expected, signaling that inflation may not be a near-term concern. Last week saw several disappointing reports on housing and durable goods, which caused investors to pull back a bit.

Carlyle's Rubenstein: U.S. tax system a 'disgrace'

Prior to that, stocks had largely been on a tear, with the Dow and S&P 500 ending their best first quarter in over a decade. The Nasdaq had its best first quarter since 1991.

Much attention will be paid later this week to the all-important jobs report for March, which is due out Friday. However, U.S. stock markets will be closed in observance of Good Friday, and bond markets will close early.

World markets: European stocks were lower in midday trading. Britain's FTSE 100 (UKX) slid 0.2%, the DAX (DAX) in Germany shed 0.2% and France's CAC 40 (CAC40) lost 0.7%.

Asian markets ended mixed. The Hang Seng (HSI) in Hong Kong gained 1.3%, while Japan's Nikkei (N225) fell 0.6%. The Shanghai Composite (SHCOMP) was closed for early April's Tomb Sweeping holiday.

Economy: A report on factory orders for the month of February is expected to show that activity picked up by 1.4%, after falling by 1% the previous month.

On Tuesday afternoon, investors will get some insight into the Federal Reserve's policy-making crystal ball, when the central bank releases minutes from its most recent meeting.

Companies: Shares of Apple (AAPL, Fortune 500) continue to hit new all-time highs, after an analyst predicted that the stock, which recently clear $600, could top $1,000.

Avon Products (AVP, Fortune 500) shares were up Tuesday, following on gains of more than 17% Monday, after the company rejected a $10 billion purchase offer from beauty company Coty Inc.

Shares of automakers Ford (F, Fortune 500) and GM (GM, Fortune 500) edge higher after competitor Chrysler Group said March was the best month for sales in four years. Additional auto and truck sales figures will be released throughout the day.

Muddy Waters: Tread carefully in Hong Kong

Daily deals site Groupon (GRPN) remains in the spotlight following a report in Tuesday's Wall Street Journal saying that the Securities and Exchange Commission is probing its revision of its first set of results as a publicly traded company. Shares were up 1% in pre-market-trading Tuesday following a loss of more than 17% Monday.

These losses came after the company announced late Friday that it was revising its fourth-quarter income and sales lower, thanks to a higher rate of customers asking for refunds.

Shares of the retailer Urban Outfitters (URBN) surged after the company gave upbeat guidance in a SEC filing.

Make Europe's pain your gain

Currencies and commodities: The dollar gained against the Japanese yen and the British pound but fell against the euro.

Oil for May delivery slipped 33 cents to $104.85 a barrel.

Gold futures for April delivery fell $0.50 to $1,677.00 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell Tuesday, pushing the yield down to 2.19%.

No comments:

Post a Comment