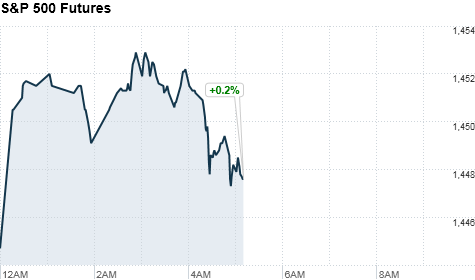

NEW YORK (CNNMoney) -- U.S. stocks were set to rise ahead of several U.S. economic reports and central bank activity.

Investors will have a bevy of economic data to sift through Thursday, a day before the government's all-important monthly jobs report.

Reports are on tap for the morning include factory orders, planned job cuts and initial jobless claims.

At 8:30 a.m. ET, the Labor Department will release data on initial jobless claims for the week ended September 29. These claims are expected to total 365,000, according to a survey of analysts by Briefing.com, up from 359,000 in the week prior.

Outplacement firm Challenger, Gray & Christmas will also release a report on announced job cuts in September before the bell.

At 10 a.m. ET, the Census Bureau will publish a report on August factory orders, which are expected to have fallen by 6%.

On Thursday afternoon, the Federal Reserve will publish the minutes of its most recent policy making meeting, at which it announced a new round of the stimulus program known as quantitative easing.

Europe also remains in focus, with European Central Bank officials gathering Thursday for their monthly policy meeting in Frankfurt.

Analysts do not expect ECB president Mario Draghi, due to speak at 8:30 a.m. ET, to announce any new initiatives -- although he may elaborate on the bank's bond-buying effort.

European stocks slid in morning trading. Britain's FTSE 100 shed 0.3%, the DAX in Germany fell 0.4% and France's CAC 40 lost almost 0.4%.

Meanwhile, Asian markets ended higher, with markets in Shanghai closed this week for a holiday. The Hang Seng in Hong Kong ticked up 0.1% while Japan's Nikkei added 0.9%.

U.S. stocks closed modestly higher Wednesday as investors welcomed improved reports on the U.S economy, though gains were tempered by concerns about growth in Europe and Asia.

Companies: Shares of Hewlett-Packard (HPQ, Fortune 500) edged higher in premarket trading, after falling 13% on Wednesday on a disappointing 2013 earnings outlook.

Shares of LifeLock (LOCK), which provides identity theft protection services, extended their losses in after-hours trading Wednesday. The company's stock slipped 7% during the trading day, its debut on the New York Stock Exchange.

Currencies and commodities: The dollar fell against the euro and British pound, but gained against the Japanese yen.

Oil for November delivery added 34 cents to $88.48 a barrel.

Gold futures for December delivery rose $8.70 to $1,788.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury slipped, pushing the yield up slightly to 1.63% from 1.62% late Wednesday.

No comments:

Post a Comment