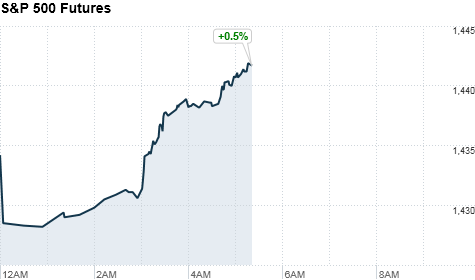

NEW YORK (CNNMoney) -- U.S. stocks were set to rise Monday as investors start the fourth quarter with fresh data amid ongoing global growth concerns.

European stocks were higher in morning trading, after Spain passed two major hurdles last week when it proposed its 2013 budget and results from bank stress tests fell in line with expectations. Britain's FTSE 100 rose 1.1%, the DAX in Germany was up 1.3% and France's CAC 40 increased 1.4%.

Europe's statistical agency said Monday that unemployment in the region hit a record 11.4% in August, unchanged from the previous month's revised rate. Meanwhile, Markit's eurozone manufacturing purchasing managers' index was bleak but still added a dash of hope Monday, as the figure came in at 46.1 for September. The latest report showed the region is still experiencing contraction, but the figure came in at a six-month high.

In Asian, Japan's Nikkei declined 0.8% after a central bank survey showed business sentiment has fallen. The Shanghai Composite and the Hang Seng in Hong Kong were closed for a holiday. But a report on manufacturing activity in China showed that growth in the factory sector slowed in September.

In the United States, fresh data will kick off a week of economic reports set to culminate on Friday with the release of the government's monthly jobs report.

At 10:00 a.m. ET, the U.S. Census Bureau will release data on construction spending for August. At the same time, the Institute for Supply Management will release its ISM Manufacturing Index for September, which is expected to tick up to 49.7 from 49.6 in the month prior, according to a survey of analysts by Briefing.com.

Investors will be looking to the ISM Manufacturing Index for further data on that sector, following a disappointing report Friday that caused U.S. stocks to finish lower. The Chicago Purchasing Managers Index for September showed manufacturing on the decline in the U.S. for the first time since 2009.

Companies: The prospects of a huge consolidation in the international mining industry looked brighter Monday, after Xstrata's (XSRAF) board of directors said it was backing a revised offer from Glencore International. The merger was first proposed in February, but had been delayed by shareholder objections.

No major earnings reports are expected Monday. However, shares of drugstore chain Walgreens (WAG, Fortune 500) will be in focus after the company reported sales and profits Friday that were down versus a year ago.

Related: China manufacturing slump drags on

Currencies and commodities: The dollar weakened against the euro, but rose against the British pound and Japanese yen.

Oil for November delivery fell 17 cents to $92.02 a barrel.

Gold futures for December delivery dropped $1.20 to $1,772.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was unchanged, with the yield holding steady at 1.64% from late Friday.

No comments:

Post a Comment