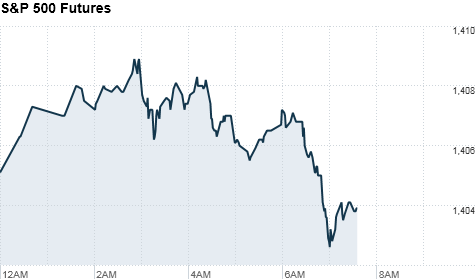

Click the chart for more premarket data

NEW YORK (CNNMoney) -- Investors may have returned from summer vacation, but they're not running back to the stock market. U.S. stocks opened slightly lower Tuesday.

Like they did for much of August, investors appear to be playing a waiting game. During this Labor Day-shortened week, investors appear to be biding their time for jobs numbers due out Friday and to see what Europe's central bankers will do to protect the vitality of the euro.

The Dow Jones industrial average, the S&P 500 and the Nasdaq all traded down between 01.% and 0.2% shortly after the opening bell.

Investors shrugged off better-than-expected monthly sales from two of the big three automakers: Ford (F, Fortune 500) and Chrysler. Manufacturing numbers and construction spending are due out later in the morning.

The latest batch of economic numbers are particularly important to investors. Many believe that the employment figures in particular will be a big part of the equation when the Federal Reserve decides whether it will announce more quantitative easing at its Sept. 12-13 policy meeting.

Related: Election won't stop the Fed

In his speech last week, Federal Reserve Chairman Ben Bernanke indicated that additional stimulus could be on the way, saying that the central bank is still willing to do whatever it takes to support the economy.

Meanwhile, Europe will once again be in focus after Moody's warned that the European Union's Aaa credit rating was at risk. Moody's revised its outlook on the EU to "negative" from "stable."

As Eurozone leaders return from summer holidays, investors are bracing for several key events in the euro area this month, starting with a crucial meeting of the European Central Bank on Thursday.

ECB President Mario Draghi is widely expected to unveil details of a new bond-buying program for eurozone governments that agree to certain conditions. But it remains to be seen if Draghi, who many view as the euro's savior, will meet investors' high expectations.

Related: ECB takes center stage after pause in crisis

U.S. stocks finished higher Friday following a bounce from Bernanke's speech.

World Markets: European stocks fell in afternoon trading after Moody's warning. Britain's FTSE 100 lost 0.9%, the DAX in Germany shed 0.5% and France's CAC 40 fell 0.5%.

Asian markets ended lower on weak manufacturing data. The Shanghai Composite slid 0.8%, the Hang Seng in Hong Kong lost 0.7%, and Japan's Nikkei edged lower 0.1%.

Chinese manufacturing contracted for the first time in nine months, adding pressure on Chinese government authorities to take steps to reverse the slowdown.

Economy: The Institute for Supply Management's ISM Manufacturing Index for August will be released at 10 a.m. ET Tuesday. The index is expected to come in at 50.0, according to a survey of analysts by Briefing.com, up from 49.8 in July.

Also on tap for Tuesday morning, the Census Bureau will release figures for July construction spending, which is expected to have risen by 0.5%.

Companies: Campbell Soup (CPB, Fortune 500) posted better-than-expected earnings Tuesday morning, sending shares of the company higher.

Smithfield Foods (SFD, Fortune 500) reported earnings of 40 cents per share, coming in bellow analyst expectations. The company cited growth in its packaged meat business, but poor performance of its fresh pork business dragged on profits.

Shares of Facebook (FB) were slightly higher, after the social network's stock hit a new low on Friday.

Currencies and commodities: The dollar picked up ground against the euro, the British pound and the Japanese yen.

Oil for October delivery shed 60 cents to $95.90 a barrel.

Gold futures for December delivery added $4.00 to $1,691.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield sharply lower to 1.56% from 1.62% late Friday.

No comments:

Post a Comment