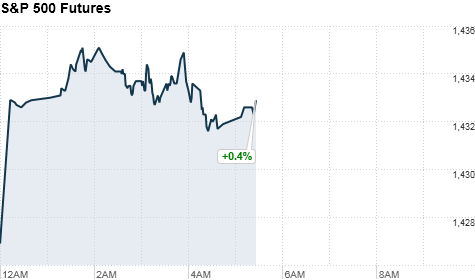

NEW YORK (CNNMoney) -- U.S. stocks were set to open higher Thursday as investors await developments out of Europe.

Europe will continue to be the driving force behind the markets, as anti-austerity protests roil Greece and Spain.

The Spanish government is expected to release its 2013 budget plan on Thursday. And Friday brings auditors' results of bank stress tests, which could give investors a better idea of just how deep Spain's banking troubles run.

On Wednesday, yields on 10-year Spanish bonds shot up to 6.06% after the leader of Catalonia called for early elections, signaling a lack of confidence in Prime Minister Mariano Rajoy. Bond yields continued to hover slightly above 6% on Thursday.

European stocks gained in morning trading. Britain's FTSE 100 added 0.2%, the DAX in Germany and France's CAC 40 rose 0.4%.

Related: Spain's precarious future

Asian markets closed higher Thursday, and the Shanghai Composite bounced off a multi-year low as the index ended up 2.6%. The Hang Seng in Hong Kong jumped 1.1%, and Japan's Nikkei ticked up 0.5%.

In the United States, investors will have several economic reports to digest on Thursday, including data on jobless claims and a revised reading on GDP.

The government's weekly report on initial jobless claims is due at 8:30 a.m. ET. Claims are expected to have edged down to 379,000, from 382,000 the previous week.

A third reading on the U.S. second-quarter gross domestic product is also being released at 8:30 a.m. ET. Economists surveyed by Briefing.com expect economic growth to come in at 1.7%, in line with the previous estimate.

Also due before the bell, the Census Bureau will release a report on durable goods orders, with economists anticipating a 5% drop in August, following a 4.1% increase in July.

Later in the morning, a report on pending home sales is due from the National Association of Realtors. Economists predict sales to have ticked up 0.5% in August, following a 2.4% jump in the previous month.

Stocks ended lower Wednesday, with the S&P 500 logging its fifth consecutive daily loss.

Companies: Discover Financial Services (DFS, Fortune 500) is scheduled to release its quarterly earnings results ahead of the market open, with analysts surveyed by Thomson Reuters expecting the company to post earnings of $1.04 a share.

Micron Technology (MU, Fortune 500) is expected to report a loss of 22 cents per share, while Nike (NKE, Fortune 500) is anticipated to announce earnings of $1.12 per share.

After the market closes, Research in Motion (RIMM) will report its earnings. The troubled Blackberry maker is expected to post a loss of 43 cents per share.

Currencies and commodities: The dollar rose against the euro, but fell versus the British pound and Japanese yen.

Oil for November delivery added 28 cents to $90.26 a barrel.

Gold futures for December delivery rose $5.10 to $1,758.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury slid, pushing the yield up slightly to 1.63% from 1.62% late Wednesday.

No comments:

Post a Comment