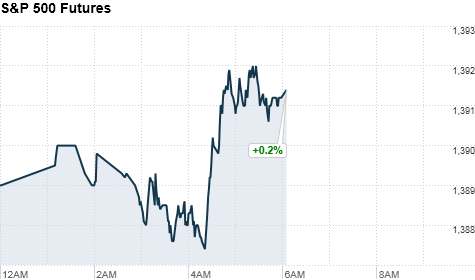

NEW YORK (CNNMoney) -- U.S. stocks head for a slightly higher open, as investors continued to cheer an upbeat July jobs report and welcomed easing borrowing costs in Spain and Italy.

U.S. stock futures were up between 0.1% and 0.5% early Monday.

With no economic reports on tap, investors will continue to keep an eye on further news about Europe's debt crisis and remain focused on financial results out of Corporate America.

Second-quarter earnings season continues Monday with results on tap from Tyson Foods (TSN, Fortune 500). Chesapeake Energy (CHK, Fortune 500), which has been in the spotlight amid takeover chatter and a management shakeup, is on tap to report after the closing bell.

Other earnings due later in the week include Disney (DIS, Fortune 500), News Corp (NWSA, Fortune 500) and J.C. Penney (JCP, Fortune 500).

Meanwhile, Wall Street will keep close tabs on news from Knight Capital Group (KCG), which is facing a $440 million loss from a software glitch that triggered a series of bizarre moves in otherwise thinly traded stocks last Wednesday, affecting how shares for some 150 NYSE-listed stocks were routed.

According to news reports citing people with familiar with the matter, Knight has secured a lifeline worth about $400 million from a group of investors including TD Ameritrade (AMTD), Blackstone Group, Getco, Stifel Nicolaus, Jefferies Group and Stephens Inc.

An announcement on the deal is expected Monday morning, according to the reports.

U.S. stocks rallied Friday as a stronger-than-expected July jobs report helped lift markets for the week.

World markets: European stocks were higher in morning trading. Britain's FTSE 100 ticked up 0.1%, the DAX in Germany added 0.6%, and France's CAC 40 gained 0.5%.

Asian markets rallied, as investors cheered better-than-expected U.S. jobs report from last Friday. The Shanghai Composite rose 1%, the Hang Seng in Hong Kong climbed 1.7%, and Japan's Nikkei surged 2%.

Economy: No major economic reports are due on Monday.

Companies: Tyson Foods is expected to report earnings of 54 cents a share on $8.7 billion in revenue, according to a survey of analysts by Thomson Reuters.

Late Friday, Warren Buffett's Berkshire Hathaway (BRKB) reported a drop in earnings due to derivatives losses, but posted strong gains in its insurance business.

Currencies and commodities: The dollar rose against the euro and British pound, but slipped versus the Japanese yen.

Oil for September delivery fell to 33 cents to $91.07 a barrel.

Gold futures for August delivery rose $2.50 to $1,608.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 1.55% from 1.58% late Friday.

Sunday marked the one-year anniversary of Standard and Poor's downgrade of the U.S. credit rating from AAA.

Despite S&P's blow, yields on U.S. government debt across all maturities have hit record lows in the post-AAA world as investors' enthusiasm for Treasuries intensified amid a tepid U.S. economic recovery, a growing European debt crisis, and slowing growth in emerging markets -- particularly China.

In recent weeks, the yield on the 10-year Treasury note has fallen to a record low around 1.4% from 2.6% a year ago. The 30-year yield has dropped to less than 2.5% from almost 4% last August. As investors buy Treasuries and drive up the price, yields continue to decline.

No comments:

Post a Comment