NEW YORK (CNNMoney) -- U.S. stocks were poised to open higher Thursday, as investors look past the latest European worries and await key earnings and economic reports, as well as the final pricing for Facebook's initial public offering.

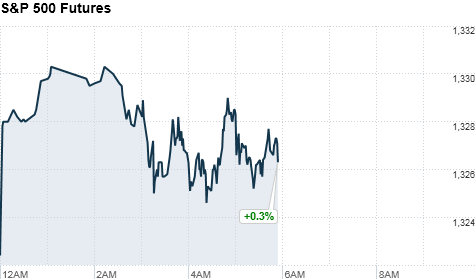

The Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all slightly higher. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

Stocks declined for a fourth straight session on Wednesday, as positive economic data in the U.S. failed to counter increasing pessimism over Greece's fiscal woes.

European leaders Wednesday voiced support for keeping Greece in the eurozone, but cautioned the debt-ridden country must stick with unpopular austerity measures if Greece is going to continue to receive help. A new vote is set for Wednesday June 17.

Meanwhile, the Greek population is responding to the crisis by making massive withdrawals from Greek banks over fears they could have their savings converted to a devaluated currency soon, should Greece be forced to drop the euro.

Investors remain worried what a Greek exit from the eurozone would mean for broader financial system in both Europe and around the globe.

World markets: European stocks slid in morning trading. Britain's FTSE 100 (UKX) lost 0.6%, while the DAX (DAX) in Germany slipped 0.5% and France's CAC 40 (CAC40) fell 0.7%.

Most Asian markets ended higher on a report that showed the Japanese economy grew at 1.0% in first quarter, which was much better than forecasts. Tokyo's Nikkei (N225) gained 0.9% on the news, while the Shanghai Composite (SHCOMP) rose 1.4%. Hong Kong's Hang Seng (HSI) slipped 0.3% despite the report.

Economy: Investors will get new data on the labor market before the opening bell Thursday, followed by a report on manufacturing from the Philadelphia Fed at 10:00 a.m. ET.

Initial jobless claims are forecast to fall by 2,000 for the week ending May 12, from 367,000 to 365,000. Economists surveyed by Briefing.com expect continuing claims to jump from 3.23 million to 3.25 million.

Companies: Early Thursday Wal-Mart (WMT, Fortune 500), the nation's largest retail, is expected to report improved earnings of $1.04 a share, according to analysts surveyed by Thomson Reuters, up 6% from a year earlier. Revenue is also expected to rise 6%.

Facebook (FB) is expected to price its initial public offering after the bell on Thursday, ahead of the start of trading of its shares Friday.

The social networking site upped the target price range for its stock earlier this week from $34 to $38 per share. And the company announced Wednesday that 25% more shares of the company will be sold than previously thought.

The additional shares, disclosed in a filing with the Securities and Exchange Commission, could fetch an extra $3 billion -- bringing the total raised through Facebook's offering to as much as $16 billion, making it the most valuable tech IPO in history.

Sears Holding (SHLD, Fortune 500) will also report before the market open, and is expected to show a loss of 67 cents per share on revenue of $9.7 billion. Ross Stores (ROST, Fortune 500) is expected to report revenue of $2.2 billion and earnings per share of 93 cents.

Shares of JPMorgan Chase (JPM, Fortune 500) dropped another 2% on Wednesday, after the director of the FBI confirmed his agency had launched an initial investigation into a $2 billion trading loss suffered by the bank.

Currencies and commodities: The dollar was slightly higher against the euro and Japanese yen, and posted stronger gains against the British pound in morning trading.

Oil for June delivery gained 19 cents to $93.00 a barrel.

Gold futures for June delivery rose $11.70 to $1,548.30 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell slightly, lifting the yield up to 1.79% from 1.76% late Wednesday.

No comments:

Post a Comment