NEW YORK (CNNMoney) -- U.S. stocks were poised to move higher Wednesday, as investors pushed aside worries of a cooling Chinese economy ahead of more U.S. housing market data.

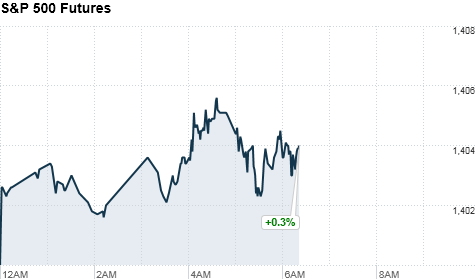

The Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were slightly higher ahead of the opening bell. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET.

The housing market remains in focus Wednesday, with a report on existing home sales and the weekly Mortgage Bankers Association application index on tap.

Stocks have been supported this year by rising hopes for the U.S. economy and easing concerns about the debt crisis in Europe. But the housing market's distress still weighs heavily on investors, as they continue to look for signs of recovery.

Data released by the government on Tuesday showed a big increase in requests for building permits in February, although new home construction was weaker than expected.

U.S. stocks closed lower Tuesday, as concerns about slowing growth in China overshadowed the upbeat housing data.

Economy: Existing home sales for February are expected to come in at an annual rate of 4.60 million, according to a survey of analysts by Briefing.com -- up from a rate of 4.57 million in January.

Gas prices rose by 1.8 cents to a national average of $3.86, according to motorist group AAA. Wednesday marks the twelfth consecutive day prices have risen. Gas prices are up 17.8% this year.

World markets: European stocks advanced in morning trading. Britain's FTSE 100 (UKX) edged higher 0.2%, the DAX (DAX) in Germany added 0.3% and France's CAC 40 (CAC40) increased 0.4%.

Asian markets ended mixed. The Shanghai Composite (SHCOMP) ticked up 0.1% while the Hang Seng (HSI) in Hong Kong shed 0.2%. Japan's Nikkei (N225) lost 0.6%.

Companies: In corporate news, firms including food producer General Mills (GIS, Fortune 500) will release their quarterly results Wednesday morning.

Analysts surveyed by Thomson Reuters expect General Mills to report quarterly earnings of 55 cents a share, flat versus last year, on $4.1 billion in revenue.

After Tuesday's close, Oracle (ORCL, Fortune 500) reported fiscal third quarter earnings of 62 cents a share, up from 54 cents a share a year earlier. Analysts had forecast earnings of 56 cents a share. Shares of the tech company were up slightly in premarket trading.

Bernanke rails against gold standard

Currencies and commodities: The dollar lost ground against the euro and the British pound, but strengthened versus the Japanese yen.

Oil for May delivery rose 52 cents to $106.59 a barrel.

Gold futures for April delivery rose $8.80 to $1,655.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury dropped, sending yields up to 2.39% from 2.37% late Tuesday.

No comments:

Post a Comment